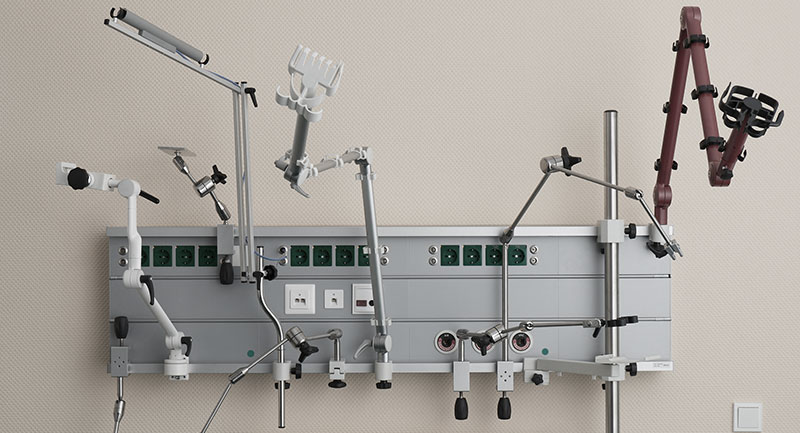

DEKOM GmbH

Das Unternehmen Die DEKOM GmbH ist ein führendes internationales IT-Systemhaus mit Schwerpunkt auf maßgeschneiderten audiovisuellen Konferenz- und Kollaborationslösungen. Mit über 25 Jahren Erfahrung, über 200

Succession planning for your own company is rarely unfettered by emotions. This makes it all the more important to know what your options are – and to consciously choose the option that will give you long-term happiness. We can give you guidance here, with the following advice.

Home | your targets | Company Succession

It is important to know that your company is still in good hands once it has been handed over. As part of the cooperative financial network, mutual respect and a long-term outlook are part of our DNA.

With 50 years’ experience as an equity investor, we know that a hand-over needs to be carefully prepared. This is why we are available to give support and guidance right from the start of your deliberations but we can also help in the planning of unprepared company successions.

There is no standard approach to company succession. We can give you the flexibility to first sell just a minority holding, to stay at the helm despite selling or to install a successor from within the family in a few years’ time.

Finding a successor within the family, preferably a daughter or son, is still the ideal scenario for most German entrepreneurs. However, it only works out in a fraction of the cases. Very often, the next generation has other plans, is too young or does not have the necessary qualifications. At least in the last two instances, it is sometimes possible to find a solution. Ask a person you trust – preferably a friend or confidant with no aspirations to become the successor and who is not part of the family – to make their own assessment. Some weaknesses that you see as exclusion criteria can perhaps be overcome with professional coaching – or may seem less serious to an outsider. And if the successor is not quite ready, there are tried and tested interim solutions: a manager from outside the family but who knows the company well could continue to run the business and take the planned successor under their wing. It is also possible to structure equity and mezzanine financing in such a way that the departing senior family member can receive their pay out without delay and their successor can slowly take up the investment.

Management buyouts – whereby an existing manager (or team of managers) not only takes over the running of the company but also becomes a shareholder – are almost as common as solutions involving successors from within the family. The manager needs neither to be sitting on a vast fortune nor to incur excessive debt in order to be able to pay you an appropriate purchase price. In most cases, management acquires a minority stake while the majority holding is purchased by an equity investor (or financial investor or private-equity company) such as VR Equitypartner, which gives management a large degree of operational freedom. If the equity investor wants to exit after several years and the company has developed successfully during that time, the management is often able to increase its shareholding.

There is nobody from within your family or the company who can be your successor? This is not an uncommon scenario these days – but equity investors often have access to a comprehensive network of experienced executives with the relevant know-how. A shareholding at preferential conditions provides the management with a strong incentive to work for the long-term success of the company. In other cases, only short-term management solutions are needed, for example for the implementation of an investment project. In such instances, equity investors like to rely on interim managers, who then withdraw – perhaps making way for a successor from within the family or the company.

In this instance you sell your company to an equity investor – and remain a shareholder yourself by acquiring shares in the acquisition vehicle set up by the equity investor for the purpose of purchasing your company. The clear advantage for you: You can realize some of the sales proceeds immediately and diversify your assets and, at the same time, finance the purchase of company shares with the help of debt and/or mezzanine financing, therefore using less equity capital. This enables you to keep benefiting from the positive development of your company while uncoupling the operational succession from the shareholder succession.

Another form of company succession: Selling to another company, usually a competitor or a company in the same sector. However, this form of succession is not always popular because the sale to a competitor can mean the loss of your company’s identity. Very often it also heralds changes to the corporate culture, and the elimination of duplicate structures can lead to job losses.

Finanzinvestoren haben sehr viel Erfahrung mit Unternehmensnachfolgen – als Teil einer Nachfolgelösung. Dabei beobachten sie immer wieder die gleichen Fehler in der Nachfolge. Fehler, die sich mit guter Vorbereitung vermeiden lassen sollten.

In diesem Dokument finden Sie 5 praxisrelevante Empfehlungen erfahrener Finanzinvestoren zum Thema Nachfolge. So vermeiden Sie von Anfang an typische Fehler, die eine Nachfolgelösung zu Scheitern bringen könnten.

Finden Sie in diesem Text Praxistipps aus der Erfahrung von Finanzinvestoren, die bereits zahlreiche Unternehmensnachfolgen erfolgreich begleitet haben. So vermeiden Sie teure und zeitintensive Fehler von Anfang an und führen Ihre persönliche Nachfolge zum Erfolg.

Welche Fehler immer wieder bei Nachfolgen begangen werden

VR Equitypartner unterstützt mittelständische Unternehmen mit maßgeschneiderten Finanzierungslösungen. Sehen Sie Beispiele unserer aktuellen und früheren Beteiligungen.

Das Unternehmen Die DEKOM GmbH ist ein führendes internationales IT-Systemhaus mit Schwerpunkt auf maßgeschneiderten audiovisuellen Konferenz- und Kollaborationslösungen. Mit über 25 Jahren Erfahrung, über 200

Das Unternehmen Accso ist ein Spezialist für Software Engineering und digitale Transformation im B2B-Umfeld. Das Unternehmen wurde 2010 in Darmstadt gegründet und entwickelt als Digitalpartner

Managing Director

Managing Director

+49 69 710 476 – 115

Managing Director

Managing Director

+49 69 710 476 – 113

Vom Hauptbahnhof Münster/mit öffentlichen Verkehrsmitteln:

Mit dem Taxi benötigen Sie etwa 10 Minuten.

Mit öffentlichen Verkehrsmitteln gibt es vom Hauptbahnhof mehrere Buslinien. Sie nehmen entweder die Buslinie 7 Richtung Kriegerweg, die Linie 15 Richtung Albachten oder die Linie 16 Richtung Mecklenbeck. Die Ziel-Bushaltestelle heißt in jedem Fall “DZ HYP/IHK”. Von hier überqueren Sie die Weseler Straße und finden schräg gegenüber den Sentmaringer Weg. Gleich im zweiten Haus auf der linken Seite (Hausnummer 21) finden Sie die VR Equitypartner GmbH.

Mit dem Auto:

Von der A1 und A43 kommend, fahren Sie am Autobahnkreuz Münster-Süd auf der B51 und später auf der B219 (Weseler Straße) Richtung Münster-Innenstadt. Nach der zweiten großen Kreuzung biegen Sie nach knapp 400 m rechts in den Sentmaringer Weg. Die VR Equitypartner GmbH finden Sie auf der linken Seite.

Frankfurt

VR Equitypartner GmbH

Platz der Republik

60265 Frankfurt am Main

Entrance:

Cityhaus I

Platz der Republik 6

Entrance via Friedrich-Ebert-Anlage

From Frankfurt Airport:

Take the A5 towards Frankfurt to Westkreuz Frankfurt. Follow signs towards Frankfurter Westkreuz and Messe. From there, drive into Friedrich-Ebert-Anlage and follow the arrows on the map.

Parking is available in the public car park “Westend” in Savignystraße.

On request, we are happy to reserve one of our visitor parking spaces in Cityhaus I for you.

The entrance is in Erlenstraße.

With public transport:

Take S-Bahn line S8 or S9 (towards Frankfurt Hbf., Offenbach or Hanau) and you will arrive directly at the main station (Hauptbahnhof).

U-Bahn line U4 or U5 – Station Frankfurt(Main) Hbf.

It then takes around 5 minutes on foot from the station to VR Equitypartner.

Tram lines 11, 16, 17, 21 – Platz der Republik stop.

Mit dem Laden des Videos akzeptieren Sie die Datenschutzerklärung von YouTube.

Mehr erfahren